India aims to become cashless now. The online mode of payment has increased, and most of us are looking for safe and secure ways of doing it. If you are also looking for the same, then this article is for you. Mobile Wallets or Digital Wallets or e-Wallet apps allow you to pay electricity bills, mobile recharge, get movie tickets and do a lot more right from your mobile. By linking your Credit or Debit Cards or Bank accounts with these e-Wallet apps, you can easily make a payment using your mobile.

You can generally load money into these digital wallets via Internet banking or via your Credit or Debit Card. On most of these e-Wallets, there is a limit of Rs 20,000 for users who have not submitted their KYC documents If you submit these documents, the limit is raised to Rs 1.00 lakh.

Before we proceed, we should know a bit about UPI, which is the infrastructure on top of which end-user apps are built, so that they can use the features offered by it. Unified Payment Interface or UPI is the new mode of payment. Sending and receiving using the UPI app is simple using Virtual Payment Address (VPA) and there is no need to add the beneficiary account details, account number, and IFSC code. Every bank has its own UPI app and makes sure that you install the UPI app of your bank, which allows you to send and receive payments between any two bank accounts.

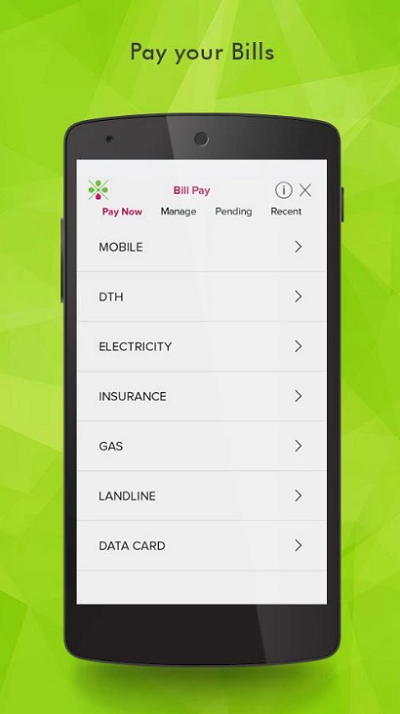

Mobile Wallets to Make Online Payments

Mobile wallets allow us to make bill payments, mobile recharge, transfer funds and a lot more using mobile. With e-Wallet apps installed on your mobile, you are in no need of carrying cash. In this post, I will list download 10 mobile wallet apps in India, apart from GPay, which almost everyone uses, to make online payments.

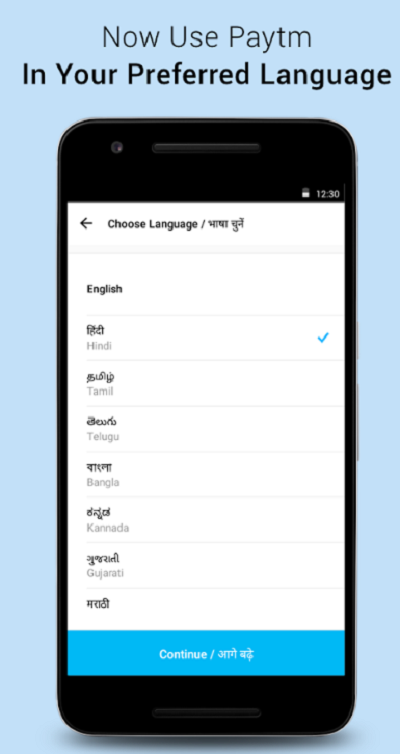

1. PayTM

PayTM is one of the best digital wallets for making payments. It allows you to add your Credit/Debit cards and link your bank account to it. Make use of QR code to send and receive payments easily. PayTM mobile wallet allows you to buy movie tickets, online mobile recharge, pay electricity bills and more from your mobile. It is available for Android & iOS

This post will show you how to use Paytm to make online payments & transfer money.

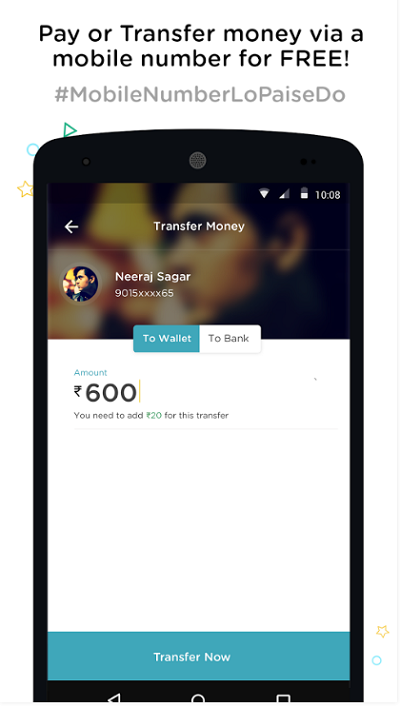

2. Mobikwik

Mobikwik is another versatile & secure app that allows you to pay or transfer money using the mobile number. It allows you to make mobile recharge and pay bills in seconds. Use Mobikwik mobile wallet and buy anything online with good discounts. Making bill payments, mobile recharge, shopping and more have become easy with Mobikwik mobile wallet. It is available for Android & iOS.

Read: Are Chinese loan apps in India safe?

3. FreeCharge

FreeCharge e-Wallet allows you to add credit and debit cards which make it easy to make payments. It is the fastest-growing digital payment platform allowing you to pay electricity bills, mobile, and DTH recharge and more. Use FreeCharge mobile wallet and avoid long queues. It makes it easy to make online and digital payments securely using mobile. FreeCharge is available for Android and iOS .

Read: How to use BHIM app for payment?

4. State Bank Buddy

State Bank Buddy by State Bank of India is the first Indian mobile wallet available in 13 Indian languages. Using this sending money, asking reminders to clear dues, instant bill payments and more from your mobile. State Bank Buddy mobile wallet helps you to do so by linking your credit or debit cards to it. It allows you to load the amount into your wallet and make payments to your contacts on the phone book. It is available for Android and iOS.

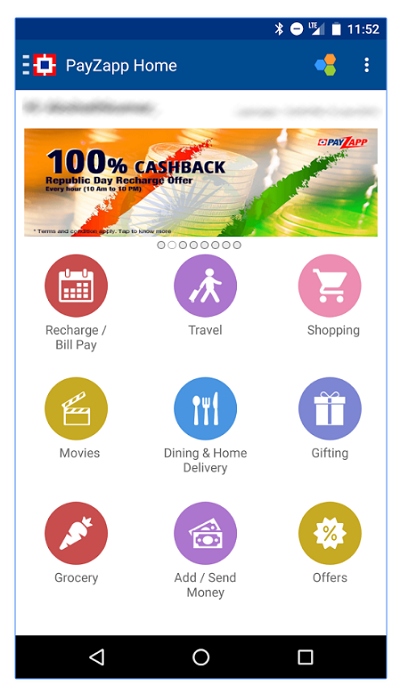

5. HDFC PayZapp

PayZapp from HDFC Nabk is available to customers of all banks and allows you to make payments with just a single click. Make payments easily by adding credit or debit card details. Your card details are safe with the bank and no need to worry about that. PayZapp mobile wallet does three security checks for every transaction. It is available for Android and iOS.

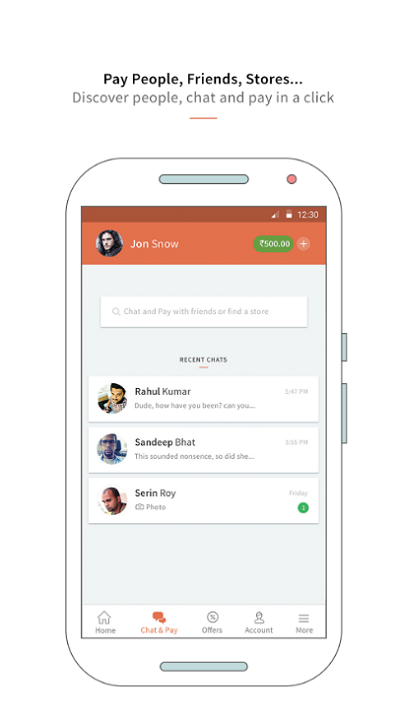

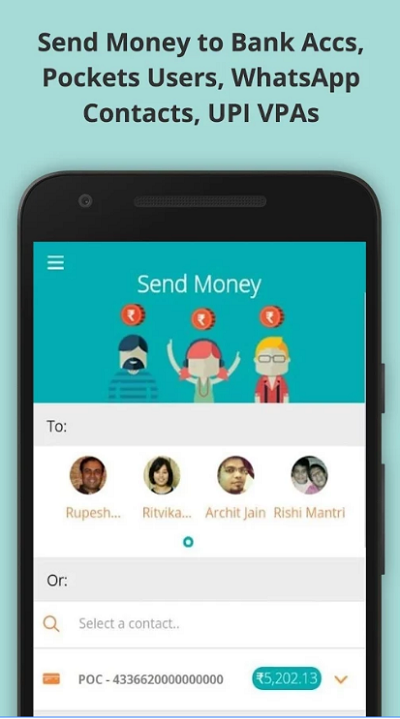

6. ICICI Pockets

Pockets app is the first mobile wallet app in India that allows you to bring UPI-based payments. ICICI developed this mobile wallet, and it helps you to make payments online. Now you can shop anywhere, pay anyone and bank with ease. It allows you to transfer money, book tickets, do mobile recharge and more. With just a single click, sending and receiving payments to and from Pocket users. It is available for Android and iOS.

7. LIME

LIME is launched by Axis Bank providing your payments, banking, and shopping facilities. It is available for an account and non-account holders. Pay your shopping bills, mobile recharge, buy movie tickets and more using LIME mobile e-wallet. Just add your credit or debit card details, and you can make payments through your mobile. It is available for Android.

8. PhonePe

PhonePe from Flipkart Group Company works over Unified Payment Interface. It allows you to make all your payments securely. You can make bank to bank transfers using Virtual Payment Address. As it is a UPI app, there is no need to add details of the beneficiary account. PhonePe mobile wallet provides you discounts and coupons when you shop online. You can top up your mobile wallet by linking it to your bank account and allows you to transact a maximum of up to 1 lakh rupees. Make sure you install this e-wallet in your mobile and make payments online. It is available for Android.

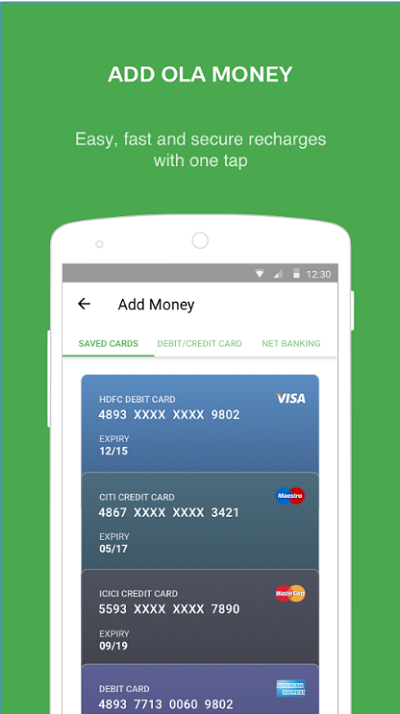

9. Ola Money

Ola Money allows you to make payments for all your daily needs. Recharge Ola Money wallet using your credit/debit card or net banking. Keep track of your transactions by looking at transaction history. Paying for the Ola and other cabs also made easy using this mobile wallet. Ola Money mobile wallet helps you to transfer money to your friends. It is available for Android and iOS.

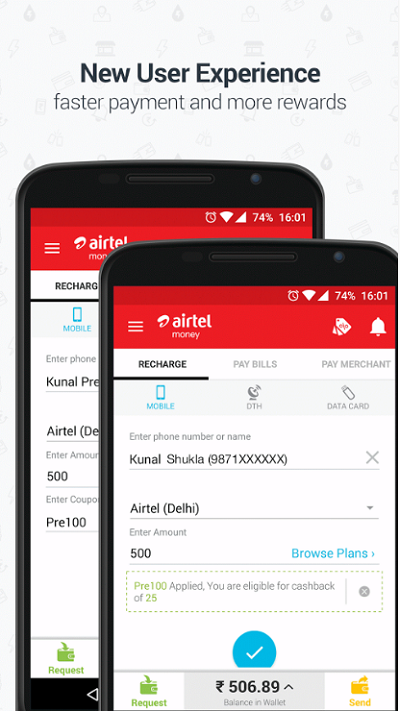

10. Airtel Money

Airtel Money wallet got launched by Airtel Payments Bank. Make payments, do mobile recharge and transfer money to your friends of any bank account using this mobile wallet. You can shop online with great discounts and coupons. Banking and remittance services are supported by Airtel Money. With this e-Wallet app, you can make payments with just a single click. It is available for Android, iOS and Windows Mobile Phone.

UPDATE: Airtel Wallet has been discontinued. Instead, you can now use Airtel UPI or BHIM app to send/receive money.

Read: What are Virtual Credit Cards and how and where do you get them.

There are several others like Oxigen, Jio, etc, that are available. Currently, MobiKwik, Paytm, FreeCharge are being accepted at Tool Plazas. FreeCharge can be used for paying Police Fine challans. Reliance Jio plans to bring on board 10 million merchant establishments for its Jio Money Merchants plan. MobiKwik is accepted by IRCTC. Paytm supports flight tickets. If you and the recipient have Paytm or MobiKwik apps installed, you can transfer money by simply entering the mobile number. You can also send money directly to bank accounts online. So make sure that you check out all their features and download the ones you want directly from their official app store only.

These are some of the best mobile wallets in India to make online payments. I hope you find this post useful and start using them right now. Want options? Take a look at these PayPal alternatives.

Using mobile wallets in your mobile helps you to go cashless and make payments from your mobile. If you are already using one, do let us know in the comments which one you prefer and why.

Read next: Best Bitcoin Wallets.

I will go with Phonepe compare to others!

Check the Moneymailme application, you can also use it for international money transfers.

Amazing article. Thanks for sharing

I go with Puut Wallet, It is one of the safest wallet.

This blog is very informative. I have recently used Cubber app which is the best mobile wallet that helps you to earn on the side. Through this wallet, you can Recharge your Phone/DTH, Pay your bills online Book bus tickets online and get best cashback offers.

Great list. There are so many websites but I want to suggest one more app that is Cubber Merchant app for Distributor & Retailer Partners. This Cubber Store app provides good margin commissions, cashbacks, offers on Mobile Recharge, Money Transfer, Bus Booking, Flight Booking, DTH Recharge, Electricity Bill Payment, Gas Bill Payment, Telephone Bill Payment, Water Bill Payment, Data card Recharge, Insurance, etc.

Such a wow article, Thanks for sharing best mobile wallet in India.