One needs to be always aware of Tax Scams, including tax refund scams, which are carried out by scamsters who pretend to be from the IRS of USA, HMRC of UK, CRA of Canada, Income Tax Department of India, and such. Scamsters contact you via fake emails, phone calls, recorded messages, SMS, etc., and either scare you with the possibility of some legal action or entice you with a tax refund!

Every tax season, Tax Scams start doing the rounds. Emails, Phone calls, or recorded messages by cybercriminals impersonating authentic tax agents have become an order of the day and continue to remain a major threat to taxpayers.

The scam artists use sinister designs that threaten police arrest, deportation, and even license revocation. With the increases in its popularity, fraudsters are also busy finding more ways to increase efficiency. Earlier, the major targets were elderly people and the immigrant population. Slowly, the focus has shifted to methods that rely on auto-dialers, robocalling, and voice mail messages to hit as many taxpayers as possible.

The story begins with an automated call. It plays a recorded message warning you that it’s “the final notice” from the tax agency such as the Internal Revenue Service, Indian Income Tax Department, HM Revenue and Customs, or the Tax department of your country. Or it could begin with an email. In any case, the recorded voice or email purports to be from a tax inspector and goes on to specify the course of action, the agency is likely to follow against you like, planning a lawsuit against you, and if you don’t return this call, you could land up in jail, soon.

How Tax Scams work

Attacks, such as these use fear as bait or the lure of a tax refund on the other hand. They rely on social engineering tactics. One such message tells recipients that there’s a pending law enforcement action against them as they have evaded tax. It is mainly used to target U.S. taxpayers. The scam pretends to contain information about a subpoena.

It could contain a web link which it wants you to click. The link could take you to a fraudulent website. Or the email could include an attachment. The file is a “document file” that Microsoft Word opens in Protected View. It contains instructions to Enable Editing. If the Enable Editing button is clicked, malicious Macros in the ‘document’ downloads malware. So one needs to always exercise utmost caution in either of the cases.

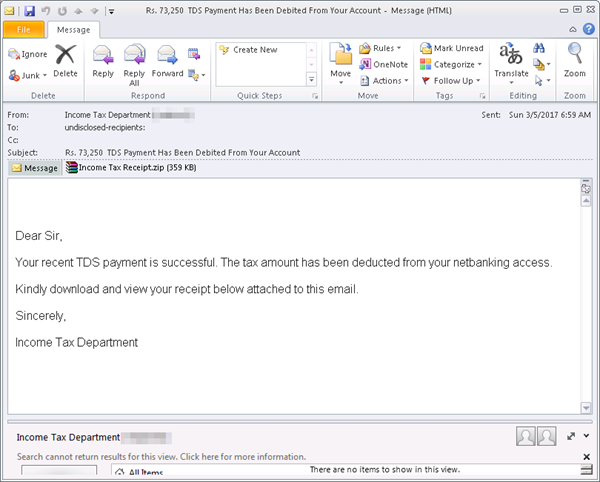

Some of the typical examples of scam messages which the use of the email are:

- You are an eligible Tax refund

- Tax Payment has been directly debited from your account

- Your Tax is overdue

- Information about your debt and tax payments

- A subpoena from IRS for Tax Evasion

Tax professionals & Accountants, on the other hand, are attacked by using messages like – I need a CPA Tax preparation, or I need to hire a new Accountant.

How do tax refund scams work?

Tax refund scams typically involve scammers creating counterfeit refund checks, posing as IRS agents, and contacting taxpayers with claims of overpayment. The scammer then requests immediate repayment of the ‘excess’ amount. Taxpayers should be wary of unexpected checks and unsolicited calls claiming to be from the IRS to avoid falling victim to these scams.

Here are a few facts about the IRS or other Income Tax authorities to keep in mind if you get a similar call

The tax agencies don’t initiate contact with taxpayers by email, text messages, or social media channels to request personal or financial information. In addition, they do not threaten taxpayers with lawsuits, imprisonment, or other enforcement action. All these signs are enough to ring a bell and caution you or save you from becoming a victim.

Moreover, agencies such as the IRS won’t ever request you to use a specific form of payment like Credit Card, a money transfer from MoneyGram, or the Western Union or a gift card from iTunes or Amazon. Only scammers resort to these modes of payment since they’re hard to track or cancel payments.

The IRS issues several alerts about the fraudulent use of the IRS name or logo by scammers trying to gain access to consumers’ financial information to steal their identity and assets. Scammers use regular mail, telephone, fax, or email to set up their victims.

Precautionary measures that can act as a line of defense and protect you from becoming a victim of this act

1] Ensure that you have good antivirus software installed.

2] Always make efforts to create a strong password to protect email accounts used to exchange sensitive data.

3] Stay alerted by being a good observer. Learn to recognize Phishing emails, Vishing or Smishing attempts that pose as banks, credit card companies, tax software providers, or even the IRS. When Identity Theft takes place over the web, you could have a problem.

4] Practice safe browsing habits. Do not click on any web links or download email attachments blindly.

5] Verbally reconfirm any change of address or direct deposit change to a refund with the client. The taxpayer and the accountant should discuss these matters verbally.

6] If you have Windows 10 installed on your system and running the Windows Defender application in the background, it will notify you about any suspicious link online or in an email message. Some malicious software will not allow you to access Windows Defender or other antivirus software. To help detect and remove the malware, you can start your computer by using a Windows Defender Offline Tool. Or you may start a Windows Defender Offline scan which is one of the built-in features of Windows Defender Settings.

7] Make sure that your Microsoft SmartScreen is always enabled. Use Device Guard to lock down devices and provide kernel-level virtualization-based security.

What to do if you receive scam emails or you fall prey to them

In case you receive suspicious emails, forward them to phishing@irs.gov right away then. Never open an attachment or link from an unknown or suspicious source. The IRS does not use electronic communications like email, text messages, and social media channels, to initiate contact with taxpayers.

Report Online Tax scams & frauds

US citizens may report scam calls to the FTC and the Treasury Inspector General for Tax Administration (TIGTA). You will have to include the caller’s phone number, along with any details you have. If you’re not sure whether a call is really from the IRS, you can double-check by calling the IRS directly at 1-800-829-1040. To report suspicious online or email phishing tax scams US citizens cal also contact or 1-800-366-4484 or report frauds to identitytheft.gov. Canadian citizens can contact the CRA directly at 1-800-959-8281. Generally speaking, you should contact the cyber cell of your local Police authorities.

As a matter of abundant precaution, it is always recommended that the taxpayer client and the accountant verbally confirm any developments.

For more, you may visit Technet and this IRS.gov page. Read here about the most common Online and Email scams & frauds.

Does the IRS send emails about tax returns?

The IRS does not send emails to taxpayers regarding tax returns or to request personal or financial information. Official communications are typically done through postal mail. If you receive an email claiming to be from the IRS, it is likely fraudulent, and it’s advisable to report it by forwarding to phishing@irs.gov.

Speaking of scams, some of these links are sure to interest you:

- Avoid online scams and know when to trust a website

- Avoid PayPal Scams

- Avoid Online Shopping Fraud & Holiday Season Scams

- Beware of Fake Online Employment and Job Scams

- Avoid Online Tech Support Scams and PC Cleanup Solutions

- Avoid Phishing Scams And Attacks

- Credit Card Skimming and Pin Theft Fraud

- Avoid Vishing and Smishing Scams

- Avoid scams that fraudulently use the Microsoft name

- Avoid Internet Catfishing Social Engineering Scams.

Leave a Reply