The financial services industry has come a long way today. Things we didn’t know were possible can now be done in the blink of an eye. We are now able to perform voluminous transactions with anyone around the globe with ease. Among the moguls which have paved the way for such advancements is Payoneer. Founded in 2005, Payoneer is a financial services company that facilitates online money transfer and offers currency conversion services too. It is largely used by freelancers to send and receive payments.

Why do you need Payoneer?

Payoneer offers a wide array of services to its customers. It allows payment transfer between users and offers local receiving accounts for free too, in certain currencies (EUR, GBP, JPY, AUD, CAD). Currently, Payoneer offers overseas payment transfer services in 200 countries and works with over 150 currencies. Its focus, however, is tended towards professional and business uses only, unlike its competitor, PayPal.

Payoneer charges different rates for its varied services. For payment transfers via a credit card, it charges 3% and 1% each for eCheck and local bank transfers. You have to pay a 1% tariff on receiving payments in USD under its Global Payment Service. As already mentioned, Payoneer offers forex services too, charging 0.5% above the interbank or mid-market rate.

Today, I am going to discuss how you can close your Payoneer Account.

How to close your Payoneer Account?

The process is simple and hassle-free:

- First thing’s first, go to Payoneer.com and log in with your credentials.

- On the top right corner of the screen, hover over ‘Help’

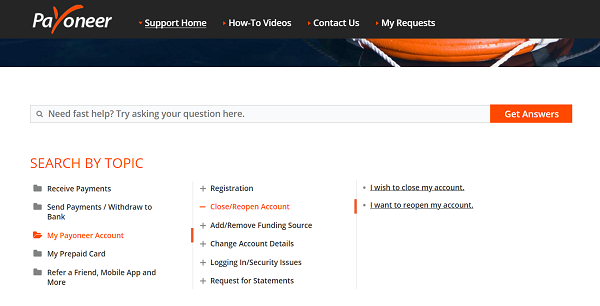

- Next, click on the ‘Support Center’ from the dropdown.

- On the left side of the screen, under the ‘Search by Topic’ section, click on ‘My Payoneer Account’.

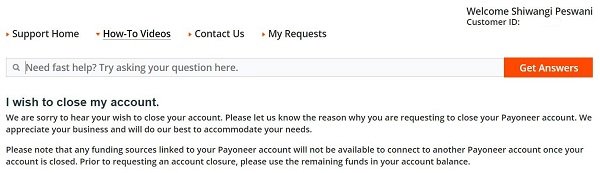

- This will open a range of options. Click on ‘Close/Reopen Account’ and further on ‘I wish to close my account’.

Before closing your account, Payoneer warns you to utilize any existing funds in your account before shutting it down. You have the option of proceeding immediately but that would result in the forfeiture of your balance.

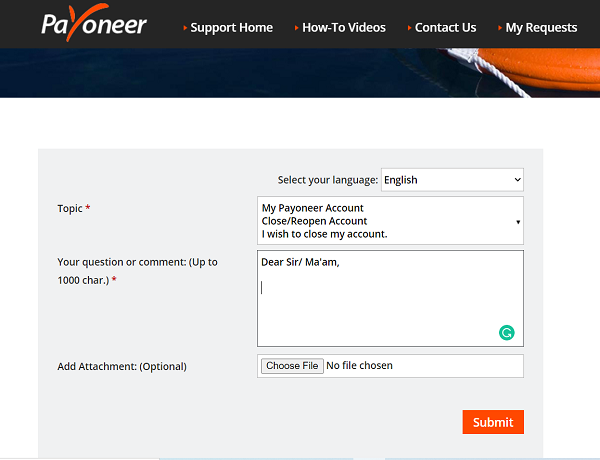

Next to the How-To Videos is the option for you to contact them, click on it.

Select the options and sub-options as you have above and fill out your grievance.

Generally, support staff from their end reverts back in an hour or so via email.

They then ask you to submit some account details before they can put a stop to it, like your birth date, your full name, and the final four digits of the bank account linked with your Payoneer account.

What next?

Closing your account on Payoneer must have you thinking about alternatives to it. Maybe you found it expensive or you didn’t find Payoneer to be secure or it lacked certain features that were important to you. Nevertheless, below are some of the most reputed online financial services platforms which can be used as viable alternatives to Payoneer:

- PayPal

- Square

- Remitly

- Google Pay

Hope you found this post useful and all your queries were solved.

Leave a Reply