There are two aspects of your life. One is the physical life that you are living – with assets such as a house, car, bank accounts, etc. You take care of these belongings in your lifetime and create a will to let people know what to do with your physical assets. The other aspect is your life associated with your computer and the Internet. You spend considerable time creating a collection of music/images/movies offline and online. You use Facebook, LinkedIn, Google Plus, Twitter, Microsoft Account, Yahoo, MediaFire, PayPal and other social or online accounts and you have important information stored in these accounts.

What happens to your Online Accounts when you die

Ever wondered what happens to all these online digital assets after your death?

Probably your computer and disks might be acquired by your kin but what about the numerous posts you made on social networking sites? What about the emails you stored with Hotmail, Gmail, and other service providers? What happens to the thousands of images you have stored on Flickr? Maybe you run a website or a blog or an online business. After your death, who is going to enjoy the movies you have uploaded to one of the cloud services…or take the earnings from these online assets?

Facebook vs. Stassen

People do not even think about their digital assets while preparing their will. More than often, they forget about their digital assets that are forever left discarded on the Internet after they die. As such, there are no rules or laws to direct Internet-based companies about what to do with the digital data of their clients when they die. It was only after certain cases came up in the courts of law that different companies came up with different solutions.

Benjamin Stassen, the 21-year-old son of Helen and Jay Stassen, committed suicide without leaving a note. When Helen and Jay could not find any cause why Benjamin took the extreme step, they decided to check out his emails and social feeds to know the reason. But this was not easy. Gmail and Facebook said they were concerned about Benjamin’s privacy and would not give the parents’, access to his account.

This is an issue for debate. In the case of physical assets, the immediate kin gets authority over the assets of the deceased in case the latter does not provide a will. But in the case of digital assets – email and Facebook feeds – there are no laws. Furthermore, these companies have contracts talking about protecting the privacy of users.

Do you think they are correct in protecting privacy and denying the request of Stassens? After all, if Benjamin wanted to share anything with his parents, he would have given them access to his Facebook and Gmail accounts while he was alive…

Anyway, Stassens went to the court of law and got orders asking Gmail and Facebook to provide them with access to Benjamin’s accounts so that they can look into the issues that drove him to commit suicide. While Google obliged, Facebook continued to deny access saying it was a matter of privacy and hence, it cannot provide the Stassens, access to Benjamin’s account. It remains to be seen if Facebook appeals against the ruling or accepts it.

Digital Assets Management

Cases such as the above have forced people to think about their digital assets and how to deal with them in the case of death. Accordingly, some of the Internet-based companies came up with their own set of rules as to what will happen to the data once the user is dead. We will talk about these rules in a while.

Create A Separate Will For Online Digital Assets and Accounts

To avoid confusion and to save problems to your kin, the best method I can see is to create a will that describes clearly as what to do with your digital belongings. You might want to instruct who gets your music and movie collections. It is a good idea to keep all the records of purchases at one place so that people can know the exact value of these collections after your death.

In the same way, you instruct whether your blog has to be maintained by anyone else or is it to be closed. You can instruct who gets access to your Flickr account and all the images in the account. Similar instructions go for all other important presence on the Internet – email accounts, Twitter, Facebook, Google, etc.

Since you cannot transfer these assets to others without giving them the passwords to these accounts, it is recommended that you create a separate will for your digital assets with different sections for different assets and their passwords. That way, only the people who get particular assets gets to know the passwords.

Note that your normal will is made public the moment you die. It is not advised to include passwords in the normal will as it will give away your passwords to everyone who can access the will. That is why I recommend a separate will entrusted to someone who respects your privacy. Also, remember that you do not have to share or give away everything you own. If you have a collection of porn, you may want it to go unnoticed rather than giving it away to your kids.

This is just a suggestion that I think will work out. Please let us know your thoughts in the comment boxes below.

Default Rules In Absence Of Will: What Happens After Your Die

The above section talked about how to deal with your digital assets. If you take the time to create a will for digital assets, it will save much effort on the part of your kin. But it may not be possible for people to decide what all to give away and what all to keep buried on the Internet. What happens if you fail to create a will for your digital assets? What happens when you do not provide access to – say Twitter – to your kin? Let us see the policies – of leading companies – dealing with the expiry of their users.

Read: How to protect Digital Assets using Web3 Antivirus

LinkedIn

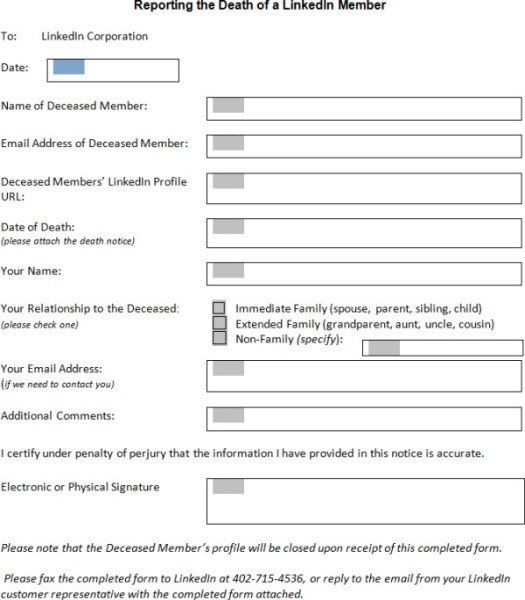

LinkedIn removes the account of deceased without transferring any data to anyone related to the dead. This means you can inform LinkedIn about the death of its user, but you cannot ask them to provide you with details of the LinkedIn account of the dead. Neither can you ask them to transfer the account to you.

LinkedIn has a form that needs to be filled for asking closure of account of the dead. Among the details, you have to fill in is the email address of the deceased without which, LinkedIn will not process the account removal request. Once you fill up the form, you have to send it to the address mentioned in the form.

What happens after your death in the case of LinkedIn is the simple closure of your account – when any of your kin or friends informs LinkedIn about your demise. No one gets to access the account, and LinkedIn won’t provide any data to anyone.

In the case of Twitter, when you inform them about the demise of a user, they will digitize all the public tweets of the user and hand it over to the beneficiary before closing the account.

You need to send the following information to Twitter:

- The Twitter account’s username (e.g., @username and twitter.com/username)

- A copy of the deceased user’s death certificate

- A copy of your government-issued ID (e.g., driver’s license)

- A signed, notarized statement including:

- Your first and last name

- Your current contact information

- Your email address

- Your relationship to the deceased user

- Action requested (e.g., ‘please deactivate the Twitter account’)

- A link to an online obituary or a copy of the obituary from a local newspaper (optional)

You need to send the above information by fax or mail to the following address:

Twitter, Inc.

c/o: Trust & Safety

795 Folsom Street, Suite 600

San Francisco, CA 94107

Fax : 1-415-222-9958”

In the case of Twitter, they do not transfer the account to anyone. They just hand over the public tweets of the deceased and then close the related account.

In the case of Facebook, it neither closes the account of the deceased nor transfers the account to his/her kin. It “memorializes” the account so that it can be viewed anytime by the current Facebook friends of the deceased. Friends may log in using their own IDs to post obituaries and other types of messages.

You can inform Facebook about the demise of their user using this form and put in a Memorialization Request. Like with LinkedIn, you need to know the Facebook profile URL and email ID of the dead user before they can “memorialize” the account. To report a profile to be memorialized, put in a request here at facebook.com.

The Facebook Legacy feature lets you Choose an Heir.

Google Account

Their policy is not very clear. I learned that they may or may not provide the kin with access to the deceased’s emails. You can initiate the process by contacting them with the following information:

- Your email ID

- Your driver’s license

- Your address

- Deceased’s email ID with one or more email headers showing up

- A copy of death certificate of the deceased.

You have to send the information to the following address:

Google Inc.

Gmail User Support – Decedents’ Accounts

c/o Google Custodian of Records

1600 Amphitheatre Parkway

Mountain View, CA 94043

Fax: 650-644-0358.

This, however, does not guarantee that they will provide the beneficiary with access to the deceased’s emails. More details can be had at Google. You can also read about the Google Inactive Account Manager.

Microsoft Account

Microsoft will delete a Hotmail account if it has been un-accessed for over 270 days. If you wish to access the Hotmail account of your deceased relative, you have to contact Hotmail. Microsoft will give you access after six months. You may be required to furnish the following documents.

- Copy of the death certificate of the user

- Proof that you are the benefactor or the deceased estate or that you have the power of attorney

- Physical mailing address

- Identification or copy of your driver’s license

- A document with the following details:

- Account name

- First and the last name of the account

- Date of the birth

- city, state and zip code

- Approximate date of account creation

- Approximate last sign in date,

All the documents should be faxed to 425-708-0096 or emailed to msrecord@microsoft.com or sent via email to the following address

Microsoft Corp – Online Services Custodian Records

1065 La Avenida, Building 4

Mountain View CA 94043.

More details can be had at Microsoft.

These are some companies that have a certain set of rules when it comes to accessing data of dead users. Note that these rules may be overridden by court’s ruling in favor of the deceased’s kin in certain cases.

Other Internet-Based Companies

While the above companies have formed policies to take care of users who cease to exist, there are many other companies on the Internet that are yet to make such policies. The list of such companies includes major photo sharing sites, cloud storage sites, music sharing sites and more.

As of now, the only way out I can see is that these companies wait for a considerable period of time and if there is no login, they disable the account.

For example, Free Yahoo Mail disables the account if there is no activity for four months.

Similarly, if there is no activity at Free MediaFire (file-sharing site) for a reasonable period of time and they need space for other users, they go ahead to deactivate the inactive users’ accounts. This means that while some of the digital assets will be lost due to the closure of accounts due to long periods of inactivity, some other assets are left active forever but without any caretakers.

PayPal, for instance, will keep the account as long as you have balance in it. Thus, neither the company nor the kin of the deceased can make use of these digital assets in the absence of a proper will.

If you transfer the ID and password, others can make use of your digital assets. In the absence of the transfer by will, if a company is notified of your death, your kin won’t be able to access your account. If you wish to pass on the information and other types of digital assets you collected during your lifetime, the best method is to create a separate will and transfer your accounts to your kin. In other words, what happens after your death is what you decide using the will.

Online Business & websites

If you run a good earning website, blog or a e-commerce site, it might be a good idea to put ALL its details in the Will, including the URLs, login credentials, bank account details and so on. This way your spouse will know what to do when you die.

But then again, this is just what I think. Let us know what is the best way to pass on the digital assets after your death.

After all … we are all going to die someday…

Another alternative could be that sites themselves give the option to users, when they are alive, to decide what to be done with their data after they die. This might not be hugely popular with their users but it will definitely help in creating awareness about this particular issue, and will lead to an informed debate among the masses and the policymakers.

Never leave what happens to the websites. This doesn’t need to be complicated; and do *NOT* necessarily do what the websites want you to do. Many of them insist on “memorializing” the account, and freezing it, when you may actually want someone to make postings on it after your death. It is *NOT* up to the website if you do things correctly.

Simply create the following documents:

1) Durable Power of Attorney

2) Last Will and Testament

One need not make separate ones just for online stuff. One of each will work.

The power of attorney names an attorney-in-fact who may act exactly the same as if s/he were you (the principal), while you’re alive, even if you’re incapacitated or even if you’re comatose (that’s what the “durable” part accomplishes); and in states like California, the power of attorney will even allow your attorney-in-fact to handle certain things after your death (normally, powers of attorney only operate while the principal is alive). However, since said certain things are mostly limited to things like giving direction for the handling of your body after death, it’s better to specify what you want to happen after your death in your Last Will and Testament, which names an executor of your estate who will then have complete power and control over ensuring that precisely what you have willed is carried out.

This whole business of the websites specifying how they will receive the information, and what hoops you must jump through is not pursuant to law. Probate law (which covers both powers of attorney and wills) sets for the proecedures for attorneys-in-fact and/or executors to contact relevant parties; and all parties *MUST* follow the law, regardless of their silly policies and procedures.

Every corporation has a registered agent who is the lawful party at the corporation who, if notified of something, *MUST* timely notify the proper parties (usually the corporation’s lawyer, if the registered agent is not, himself/herself the corporation’s lawyer) in said corporation. Once that notification is properly made, then that’s it: the corporation doesn’t get to dictate how it must be contacted and/or directed.

An attorney-in-fact simply attaches a copy of the power-of-attorney to his/her communications; and the executor of an estate simply attaches both a copy of the will along with a copy of the death certificate, and that’s it. In either case, there would, of course, be a cover letter directing the website to the specific part of the either power-of-attorney or will that is relevant to the website account; and said part of the either power-of-attorney or will should simply state that full control of the account should be turned-over to the either attorney-in-fact or executor, as appropriate, without question or delay.

If there is question which leads to delay, or delay for any other reason, or hesitation, or refusal, the attorney-in-fact and/or executor may petition a Court of relevant jurisdiction to put an emergency hearing on the docket during which s/he may move for sanctions; and during which the likely angry judge will explain the law to the website and order it to comply or both pay stiff fines and go to jail, on the spot, for contempt of court.

It’s really as simple as that. Even if the attorney-in-fact or executor happens not to have the login and password, the website must provide it. Period. No arguments. No special rules. No hoops through which to jump. This could not be more simple.

Then you simply give your attorney-in-fact and/or executor a letter of direction which specifies precisely what you want done with your accounts, and how, and by when.

Mine simply directs those representatives of either me or my estate to indicate, in a certain way, that I am either incapacitated or dead; and to provide certain information about it; and who to contact about me or my estate; and that’s it. Then it just sits there like that forever.

There are even instructions for how to set-up an auto-responder in my email accounts so that anyone who sends me an email will get an auto-reply explaining things, and linking to a web page that gives all the details.

If the website in question must be logged-into every so-many days in order for it to stay alive, then my instructions are that someone needs to do so; and for how long depends on which type of account.

All of this is in the hands of my attorney, my designated executor, and my attorney-in-fact (as well as their respective back-ups should they happen to pass, too).

It’s all part of the sort of planning that everyone — even young people — should do… with the help of an attorney-at-law, of course. Only if you’re as expert in this sort of thig as am I should you dare try to do it without the help of an attorney, and even then, I don’t recommend it. I’m *VERY* knowledgeable about all of this, and can do all my own legal writing; yet even *I* run anything I do past my lawyer even if only for a quick look-over before finalizing and executing it.

Hope that helps!

__________________________________

Gregg L. DesElms

Napa, California USA

gregg at greggdeselms dot com

Veritas nihil veretur nisi abscondi.

Veritas nimium altercando amittitur.

Thank you very much, very interesting opinion.

All estate planners and law firms should provide a service for clients to easily manage their digital information from anywhere, and be able to safely share it with loved ones. Software from OnlineSafe (www.OnlineSafe.co) makes this very easy.

Is it OK and legal to leave the password of each digital account and app with the nominated representative with clear instructions for each account AND then after the passing of the account holder; the nominated representative access each of the account and carries out the wishes as specified in the Digital Will – either to close the account or take the required action as per the Digital Will.

This removes the interference from Digital / Internet companies as they are not aware that the account holder is now deceased.

After the specific instructions in the Digital Will are carried out then the individual internet companies can be informed that the account holder is now deceased. Is this process/route legal? It is more simple and straightforward for the next of kin.

I do not see anything illegal there. It is the will of deceased being carried out. If the deceased wills, there is no need to inform sites about his or her death.