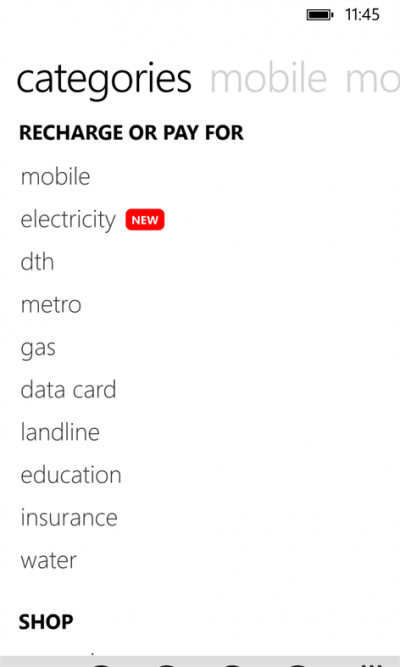

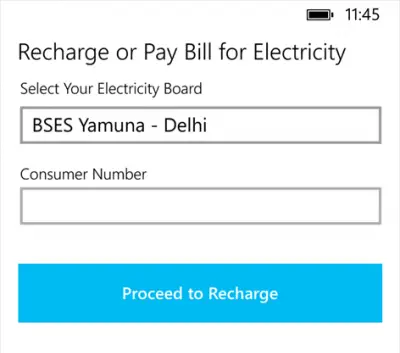

After experiencing success on iOS and Android platforms, Paytm has also rolled out its service for the popular Windows operating system. Paytm is a bill payment service that lets users transfer money from a bank account to a digital wallet, enabling them to make payments without credit or debit cards. You can use it to make data card payments, DTH payments or pay other utility bills (electricity, water, etc.) as well as for mobile recharge. Many Indians are now looking at using e-Wallets like Paytm to make online payments & transfer money using their iPhones, Android smartphones or Windows Mobile Phones.

How to use Paytm

To use Paytm, you should first have a Smartphone. Second, you should have a Debit or a Credit Card. In case you do not have a debit/credit card, you can still transfer the money into your Paytm account through a Paytm retailer who can transfer money to your account using his own Paytm account. He can charge a nominal fee for this.

Now, if you have not downloaded the app, download it from the official links mentioned at the end of this post and install it on your phone.

Once the app is installed, launch the app. Create an account by entering the required details and following the on-screen instructions. To complete the registration process, you will be prompted for an OTP or One Time Password. Enter the OTP you receive through SMS.

Now, set a password for your account. Once done, log in to the account. The benefit of using Paytm is the same login details can be used to login into Paytm via a web browser to make online payments. No additional account is required.

The benefit of using Paytm is the same login details can be used to login into Paytm via a web browser to make online payments. No additional account is required.

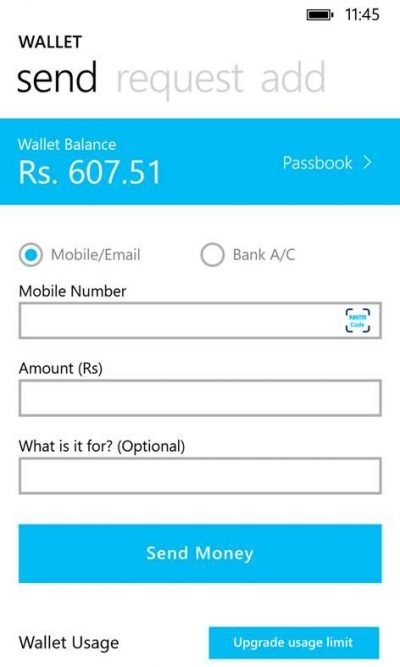

Having all things in place, add some amount to your account. The maximum limit set for a single account is INR 20,000. To complete the payment, select an option to pay – Debit card or Credit card. Net Banking as a payment mode is also available for use.

Authenticate your transaction using OTP or 3D Secure PIN, and you’re done! Once you have the requisite amount in the wallet, you can use it for payment. Most of the local retail store accept Paytm.

Now, to make the payment for any purchase made, there are two main options available:

- Scanning the Paytm QR code displayed by the retailer

- Using the Mobile number of the Paytm account holder.

An additional method to pay through Paytm is via the QR Code in your app. In this method, the retailer will scan the code on your phone and then you can enter the amount you want to pay him.

Paytm also offers an offline payment option. You have to call a toll-free number 1800 1800 1234 and perform the online transaction without using the Internet. To make the payment, you and the merchant need to create a 4-digit Paytm PIN. Next provide the mobile phone number of the recipient and enter the payment amount. Finally, you need to provide the recipient’s Paytm PIN. The amount will be transferred to the recipient’s Paytm account.

Paytm mainly functions as a Digital Wallet, a term used for an electronic device that allows you to make electronic commerce transactions typically through your mobile phone. It gives instant access to your accounts – just like the different cards you keep in your wallet but without the bulky rubber bands holding it together. In case you wish to check out the options, here is a list of some of the best Mobile Wallets in India.

Read: How to send and receive money from Zelle

Is the mode of economic transaction via Paytm secure?

Yes! Money stored securely in your Paytm Cash account is on a PCI DSS security-certified commerce platform that uses VeriSign’s trusted technology.

You can download the Paytm app for your smartphone here: Windows PC | iPhone | Android Phone.