Almost all financial transactions have moved online in India, where UPI takes a major chunk of consumer transactions daily. To provide a more convenient and efficient platform, the government of India and the Reserve Bank of India implemented Aadhar-based authentication for payments, which is called Aadhar Enabled Payment System (AePS). Like every other payment method, the hackers and exploiters started their frauds with the Aadhar Enabled Payment System too. In this guide, we delve into the details of Aadhar Enabled Payment System (AePS) frauds and give tips to safeguard from it.

What are Aadhar Enabled Payment System (AePS) frauds?

Aadhar Enabled Payment System (AePS) works through Aadhar authentication with your fingerprints. When you go to a bank, post office, or kiosk, you use your Aadhar card number and your fingerprint to withdraw the amount from your bank account. It is as simple as that. Fraudsters and scammers are now on to it to cheat people and withdraw their hard-earned money from their bank accounts without their knowledge.

They collect Aadhar card numbers and fingerprints from old documents or some other sources where you give your fingerprint. As every bank account is linked to Aadhar, they are at risk because of your Aadhar number and fingerprints in the hands of scammers. They use your Aadhar number and fingerprints for authentication and withdraw money from your bank accounts. You do not get any one-time password (OTP) for these transactions. You will only be intimated regarding the withdrawal after the transaction is complete. By the time you check your bank account for unrecognized transactions, they do multiple transactions and withdraw all your money.

Aadhar Enabled Payment System frauds are on the rise along with the UPI frauds. You can control or reject a transaction when you get a notification on your UPI application. But with AePS, there is not much you can do to stop the transactions as they are happening.

Also read: How to block GPay, PayTM, PhonePe (UPI ID) when phone is lost

How to protect yourself from Aadhar Enabled Payment System (AePS) frauds

To protect yourself from AePS frauds, do the following:

Don’t share Aadhar and biometric information: Never share your Aadhar and biometric information with anyone unless if it is required by a trusted government authority. When you are sharing those sensitive details, make sure to check if they are what they claim to be.

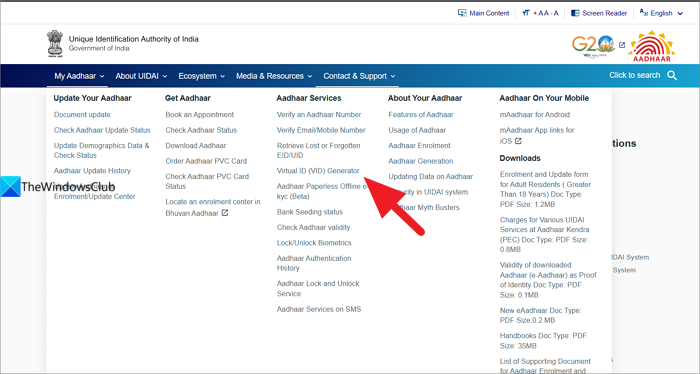

Create a virtual ID: A virtual ID on your Aadhar is a temporary revocable 16-digit number mapped with your Aadhar number. It can be used when you need to use Aadhar for e-KYC or authentication without giving out your Aadhar number. Go to the UIDAI website and create a virtual ID using your Aadhar number and registered mobile number.

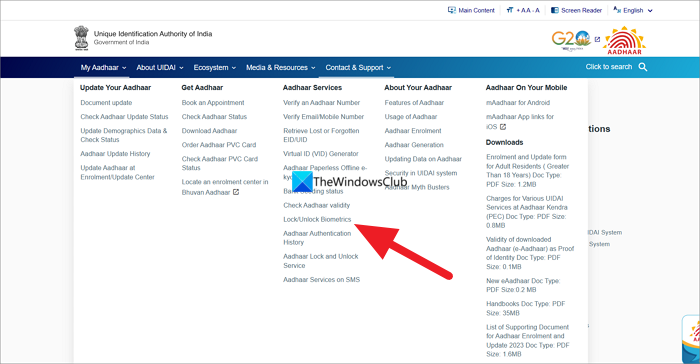

Lock your biometric details: On the UIDAI website, you can lock your biometrics information under Aadhar Online services to prevent misuse using your Aadhar number and registered mobile number.

Report frauds: When you notice frauds with your Aadhar or bank accounts, report them immediately to authorities via helpline number 1930. Also, report the incident on the National Cybercrime Reporting Portal and your bank.

Also read: Online Fraud in Cyber crime: Prevention, Detection, Recovery

Can someone withdraw money using Aadhar OTP?

Yes, if a scammer has your Aadhar number and access to the OTPs your Aadhar generates in real-time, they can withdraw money from your bank account. You need to be aware of such fraud and stay vigilant.

What are the disadvantages of Aadhaar enabled payment system?

Aadhar Enabled Payment System which was introduced for the convenience of customers while withdrawing money from their bank accounts, poses serious security threats. Just with your Aadhar number and biometrics, anyone can withdraw money from your bank account without your knowledge until it has happened.

Also read: What is NavIC from India?

Leave a Reply