In the era of ever-increasing online security scams, the importance of knowing one’s customer verification can’t be overstated. As businesses have started their online venture to expand their territory, the need for reliable KYC verification software is at an all-time high. So to curb this demand, in this article, we will dig into the options available in the market and find the suitable one.

What is KYC software?

Well, to keep it short and precise, KYC (Know Your Customer) software is one of the safety measures for online businesses in the form of software. Safety from what? Safety from fraud, money laundering, and other illicit activities. These KYC software are designed to verify and authenticate the identity of their customers by keeping tabs on them. This is done so that it allows businesses to have accurate and up-to-date data on individuals and entities.

Now we understand what KYC software’s purpose is. However, it is also essential to understand what we should look for in this software. Document verification, Biometric authentication, Anti-money laundering compliance, Risk assessment, and data verification are some of the features that, if available, make the software perfect for the users.

Best KYC Verification Software

If you are looking for some of the best KYC verification software, check out the list mentioned before:

- Jumio

- Salv

- Trulioo

- Onfido

- Veriff

Let’s get started with the KYC verification software.

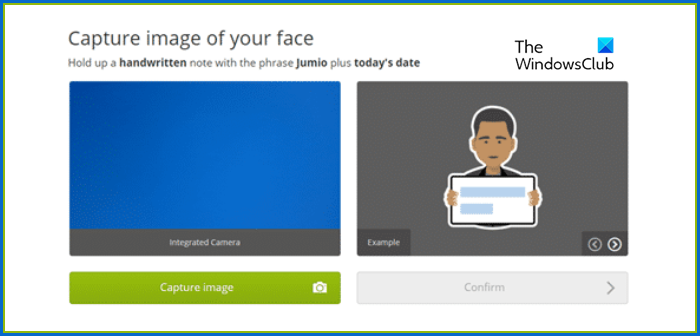

1] Jumio

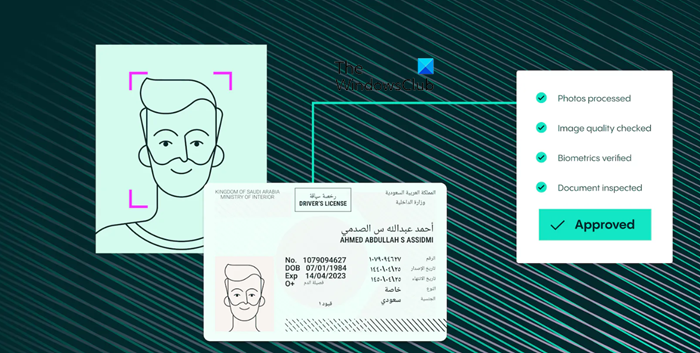

One of the leading names in this industry is Jumio. To make it excellent for its users, this platform uses advanced optical character recognition (OCR) to authenticate documents like passports, driver’s licenses, and IDs.

With the long list of features comprising biometrical recognition and liveness detection, it would be a waste of resources to let go of Jumio. The platform surely works hard to help businesses meet regulatory compliance requirements, especially in industries like finance and fintech by offering integrations with some top-notch companies such as Amazon Web Services, Azurian, Microsoft, Oracle, and many more. This platform is also known for its mobile-friendly solutions that allow seamless customer interactions.

2] Salv

Moving onto Slav, a RegTech company is another known name on the list. This platform is known for providing AML software for banks and fintech, thus boosting compliance by preventing fraudulent users.

Here, the platform has a special feature called Risk scoring that calculates the customer risk based on KYC data and transactional behavior. And the best part is that the scoring rules match FinCEN and FCA guidelines and audit scenarios.

3] Trulioo

Moving on to another prominent player, Trulioo is known for its global reach in the field of identity verification and KYC solutions. Just like Jumio, this platform also offers document verification and biometric verification methods, including facial recognition techniques.

Trulioo has something that sets this platform apart from others and that is electronic identity verification. This feature enables businesses to reduce the need for in-person interactions. It has other regulatory compliances as well, such as AML and KYC regulations, and offers risk assessment and API integration. Therefore, give it a try.

4] Onfido

The innovative and advanced identification platform, Onfido leverages AI (Artificial Intelligence) and machine learning to do the job. This platform truly stands on giving its best, as the platform exceeds in document verification through its use of advanced OCR technology.

To further solidify security, Onfido incorporated with liveness detection, requires users to produce a selfie or live video for authentication. It is one of the best options for organizations generating in numerous regions because of its global coverage.

5] Veriff

When talking about industries such as finance, fintech, and Online marketplace where KYC and AML regulations are crucial, it is not possible to leave Veriff behind. This user-friendly platform is known for its simplicity and level of precision and transparency.

Just like the above-mentioned platforms, users will get the same features such as document verification, biometric authentication, and liveness detection.

That’s it!

Read: How to add Two Step Verification to your Google Account

Does KYC software have anti-money laundering features?

Yes, although KYC and AML (Anti-Money Laundering) are distinct concepts, some KYC software does provide this feature as well. Trulioo, ComplyAdvantage, and Veriff are some of the names of KYC software solutions that often include AML features such as transaction monitoring, and risk scoring.

Read: How to set up Google My Business?

Why is KYC screening important for online companies?

KYC (Know your customer) screening is crucial for maintaining trust with customers, managing risks, and compliance with regulations. It’s necessary to prevent fraud, make right and thoughtful decisions, as well as build trust. As a customer, I will more likely trust a company that prioritizes its security and privacy.

Read: Free Personal Finance & Business Accounting Software for Windows.