In this article, we will talk about what UPI ID is and how UPI works. According to reports, there are at present 300 million UPI users and 500 million merchants who use UPI to accept money in their bank accounts. This data indicates how popular UPI is in India.

In the year 2014, the Government of India launched Pradhan Mantri Jan Dhan Yojna. The aim of this scheme was to make financial services like basic savings bank accounts, access to need-based credit, remittances facility, insurance, and pension available to the excluded sections, i.e., low-income groups and weaker sections in India. Under this scheme, more than 125 million bank accounts were opened as of 2015.

Now, the next step of the Government of India was to revolutionize digital transactions so that every Indian citizen can enjoy smooth and effortless banking transactions directly from their mobile phones. Hence, in 2016, NPCI (National Payments Corporation of India) launched UPI in India.

What is UPI?

UPI stands for Unified Payments Interface. It is a payment mechanism in India that offers seamless money transfer from one bank account to another bank account instantly. UPI was introduced in India by NPCI (National Payments Corporation of India) on 11 April 2016. UPI is regulated by the Reserve Bank of India (RBI).

What is UPI ID?

UPI ID is a unique Virtual Payment Address (VPA) that is created automatically when a user creates an account on UPI-supported apps with the mobile number registered with his bank, like Paytm, Google Pay, etc. In addition to this, users can also create a custom UPI ID on their own by logging into their Bank’s official app or a UPI app.

You can transfer money from your bank account to another person’s bank account via different ways, like NEFT, IMPS, etc. UPI is also one of the money transfer mechanisms. To transfer money through UPI, you need the following two things:

- Your UPI ID

- Receiver’s UPI ID

Advantages of UPI

UPI offers a lot of advantages as compared to NEFT and IMPS. NEFT and IMPS are the old money transfer mechanisms in India. IMPS is an instant money transfer service, whereas NEFT takes time. Let’s see some of the advantages of UPI:

- UPI is an instant money transfer service.

- It is available 24*7, 365 days a year. This means that you can transfer money to any person at any time via UPI.

- It also allows you to send a request to receive money in your bank account. This is the reason why UPI has become popular among small, medium, and large-scale merchants since its launch.

- The UPI Autopay feature allows you to create a UPI Mandate for automatic transactions. This feature is useful for recurring payments.

- Because small to large-scale merchants have accessed the UPI, you can do online transactions in place of your Debit cards. Hence, UPI also eliminates the need to carry Debit cards.

Structure of a UPI ID

UPI ID has a simple structure in which a custom name or number is followed by a UPI handle. Users can use their contact numbers, Adhar Card numbers, or a custom name to create their UPI ID. This UPI ID is followed by a UPI Handle depending on the bank holding their bank accounts or the TPAP used to create a UPI ID.

For example, if you have an account in Kotak Mahindra Bank and you use its application to create your UPI ID, your UPI ID looks like this:

<custom name or your registered mobile number>@kotak

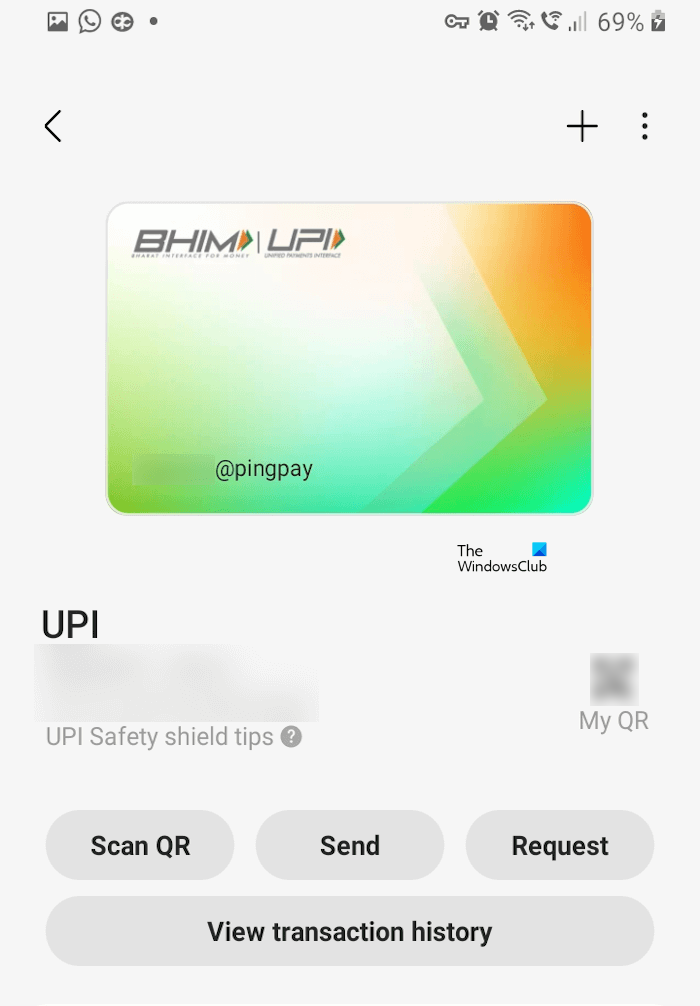

If you use a TPAP, like Samsung Pay to create a UPI ID, your UPI ID looks like this:

<custom name or your mobile number registered with your bank>@pingpay

The UPI Handle is different for different TPAPs. Some TPAPs use more than one UPI Handle depending on the TPAP’s partner banks. For example, the partner banks of Google Pay are SBI, ICICI Bank, HDFC Bank, and Axis Bank. Hence, if you create a UPI ID using Google Pay, your UPI ID will have any one of the following handles:

- @oksbi

- @okicici

- @okhdfcbank

- @okaxis

The complete list of TPAPs and their partner PSP Banks is available on the official website of NPCI.

How does a UPI work?

Before we proceed, it is important to know the participants in UPI. The following are the participants in UPI:

- Payer PSP

- Payee PSP

- Remitter Bank

- Beneficiary Bank

- NPCI

- Bank account holders

- Merchants

PSP stands for Payments Service Providers. A PSP Bank is a member of UPI that connects to the UPI platform to provide a UPI Payment facility to the users. One more term related to the UPI is TPAP (Third Party Application Provider). TPAPs are the service providers that participate in UPI through a PSP Bank.

Examples of TPAPs include Google Pay, SAMSUNG Pay, PhonePe, WhatsApp, etc. Examples of PSP Banks include Axis Bank, RBL Bank, SBI, HDFC Bank, ICICI Bank, etc.

The Remitter bank is the bank holding the bank account of the payer where the debit of the UPI instruction is received from the payer to be executed in real-time. In simple words, the Remitter bank is the bank in which the payer holds his account.

Let’s see how the UPI works. UPI has the following two working mechanisms:

- PUSH mechanism

- PULL mechanism

PUSH mechanism in UPI

The transactions initiated by the payer to send money to the receiver fall under the PUSH mechanism in UPI. This mechanism is commonly used when users need to do transactions while making a purchase or while sending money to their family and friends.

- The payer initiates a transaction by entering the recipient’s UPI ID, amount, and an optional note.

- The UPI-enabled app forwards the transaction request to the payer’s PSP.

- PSP Bank forwards the request to the NPCI.

- Now, NPCI forwards the request to the payee’s PSP for address resolution.

- Once the address is resolved, the bank details of the payee are sent to the NPCI.

- Now, NPCI will send a request to the payer’s bank to check his account details, account balance, and fund availability. The request is received by the payer’s bank which validates the authenticity of the payer’s credentials, checks the account balance, and confirms the same to NPCI.

- If funds are available, the funds are deducted from the payer’s account and a credit request is sent to the payee’s bank. The payee’s bank approves the request and money is credited to the payee’s bank account.

- After receiving funds, the payee’s bank sends the confirmation status to the NPCI UPI server. The UPI server then generates a reference ID and passes the confirmation status and the reference ID to the payer’s PSP.

- Now, the payer’s PSP passes the same to the payer.

PULL mechanism in UPI

When a user requests money from another user, it falls under the PULL mechanism in UPI. This method is used to receive money from friends and family, bill payments, etc. If you have made a payment to a bill via UPI, you might have noticed that you receive a request from the biller in your UPI app, depending on the UPI ID and UPI handle you have entered. Now, you can approve or deny the request by opening that particular UPI app. This is an example of the PULL mechanism in UPI.

The PULL mechanism of UPI transactions works the same as the PUSH mechanism but in reverse order. However, in the PULL mechanism, the payer has to approve the request received from the payee. After the approval of the request, the amount is deducted from his account and credited into the beneficiary’s account. Both the payer and payee receive the notification or message after the transaction is completed successfully.

If the payer declines the money request from the payee, the beneficiary does not receive the money. In this case, the payee receives a message or notification that the payer has declined his money request.

How to send money through UPI

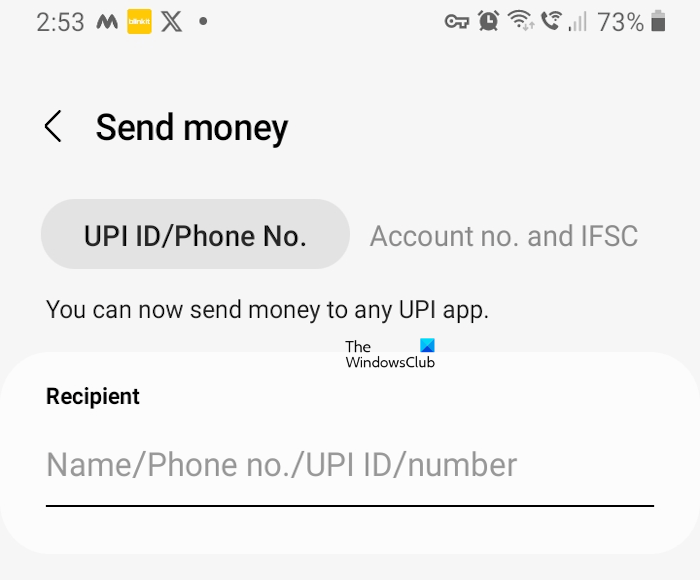

To send money through UPI, follow the steps below:

- Open your UPI-enabled app.

- Enter the security PIN (if applicable).

- Tap on Send money.

- Enter the UPI ID of the beneficiary.

- Tap on Verify.

- Check the name displayed on your screen after the verification of the UPI ID. If the name is correct, enter the amount and tap Next or Send.

- Enter your UPI transaction PIN and tap Next or Send.

Read: How to use BHIM app for payment?

Receive money through UPI

To request money from your friend or any other person, follow the steps below:

- Open your UPI-enabled app.

- Enter the security PIN (if applicable).

- Tap on Request money or other similar option.

- Enter the UPI ID of the person from whom you want to receive money.

- Enter the amount you want to receive and click Next, Submit, or other similar option.

- Tap on Request, Submit, or other similar options.

- The payer will receive a notification on his phone. Ask the payer to open his UPI-enabled app and go to the Pending Request section.

- Ask the payer to tap on Accept. He has to enter the UPI transaction PIN to complete the transaction.

After the successful transaction, you will receive money in your bank account.

Read: How to block GPay, PayTM, PhonePe (UPI ID) when phone is lost

Why US doesn’t have UPI?

No doubt, UPI has brought a revolution in the digital payment system in India. Because UPI has made digital transactions easiest for the citizens of India, it has impacted the influence of card companies in India, like VISA, MasterCard, etc. VISA and MasterCard are losing their dominance in the Indian market.

After achieving huge success in the Indian market, the Government of India decided to launch UPI at the International level. For this purpose, the Government of India formed NIPL (NPCI International Payments Limited) after the approval of the NCPI board and RBI. Today, UPI is expanding in the international market. Some of the countries that accepted UPI include Bhutan, Cambodia, Singapore, UAE, Malaysia, etc. This indicates how fast UPI is expanding globally.

If UPI enters the American market, it will pose a threat to Visa and MasterCard, and hamper their dominance. This can be one reason why these companies do not want UPI to be implemented in the USA.

UPI also allows users to link multiple bank accounts with a single UPI app. This can bring other banks into the market which can challenge the giant players of the banking system in the USA, like Bank of America.

Moreover, UPI can also challenge similar mechanisms in America, including Zelle, FedNow, etc. Zelle does not allow transactions between parties other than banks, like payment apps or e-wallets. This is the limitation of Zelle which UPI can overcome. UPI has made transactions easiest by bringing all the parties to a single platform.

Because UPI is expanding in the global market, it can be used as an alternative to SWIFT in the future. These are some of the reasons why these companies will never want UPI to be implemented in America.

India’s UPI has become ubiquitous

The UPI payment system has become very popular in India, and you can see that even street vendors have set it up and are using it. In the image above, you see a German Minister who visited India, bought fresh vegetables from a street vendor, and paid the money using his phone after scanning the QR code.

Is UPI a Google Pay?

Google Pay is not UPI. UPI stands for Unified Payments Interface. It is a platform that allows users to send and receive money instantly through their smartphones. Google Pay is a TPAP. It is a third-party application that provides UPI facilities to the users through the partner PSP banks.

Read: What is RuPay payment network of India?

Who is the owner of UPI?

UPI was brought to India by NPCI on 11 April 2016. NPCI was established in India in 2008. NPCI is the owner of UPI. Currently, Dilip Asbe is the MD & CEO of the National Payments Corporation of India (NPCI). Before this, he was the Chief Operating Officer (COO) of NPCI.

Read next: How to send or receive money in WhatsApp chats.

Leave a Reply