Big Data (both structured and unstructured) has disrupted the methods by which portfolio managers now measure risks in their investment portfolio. Many of these use predictive analysis to anticipate an outcome. That said, an ever-increasing number of software programs from leading brands have made a choice somewhat difficult. Zoom Investment Portfolio Manager simplifies this task.

Zoom Investment Portfolio Manager

An ideal investment portfolio manager should effectively implement the right portfolio strategies using the available resources. Besides, it should support real-time information accuracy and feature an intuitive, easy-to-learn toolset. Zoom Investment Portfolio Manager offers all these benefits in a single package. It can be used to manage your investments in stocks, shares, and funds.

A special characteristic of this tool is that, unlike web-based portfolios that store information in the cloud or some servers, Zoom software stores data on your computer and thus keeps it confidential.

Moreover, it lets you manage more than one portfolio simultaneously. If required, you can access a detailed view of each portfolio alongside its transactions.

Set up a new portfolio

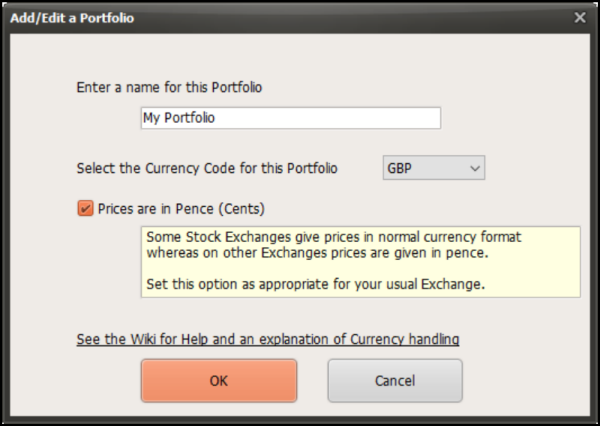

You can start afresh by creating a new portfolio. Simply enter the necessary details about the name and select the currency. You should set the currency for each portfolio and whether “Prices in pence”. Also, you must set your local Currency Code in the Portfolio Manager Options. For example,

- USD = US Dollar

- GBP = GB Pound Sterling, etc.

If you hold investments in currencies other than the ones mentioned above, create a separate Portfolio for each currency and set the correct foreign currency symbol in that portfolio.

Likewise, when entering purchases and sales of foreign investments, you should enter the cost, proceeds, commission, and tax amounts in your local currency. This is an attempt to make calculating your capital gains for your annual tax return correct and hassle-free.

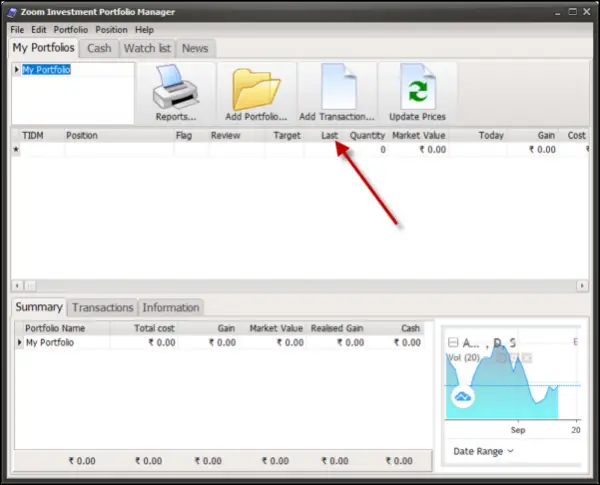

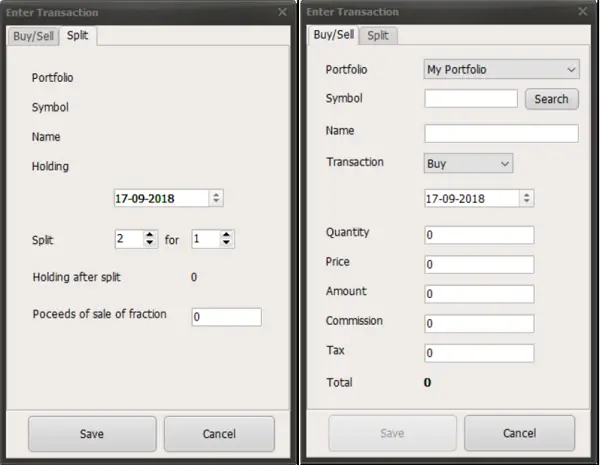

Once set up, you are ready to add transactions to your portfolios. Currently, following types of capital transactions are supported,

- Buy

- Sell

- Split

Other types of transaction can be supported through Buy or Sell options.

Once your investment positions are defined clearly, proceed further and click the ‘Research tab’ visible at the bottom to get online information about your holdings.

You have complete control over your investment profile. You can configure different options related to

- Selling Positions

- Checking for any updates in prices

- Adjusting cash balance

- Moving the selected position to another portfolio

- Getting a complete summary of each portfolio with details about the total cost, gain, etc.

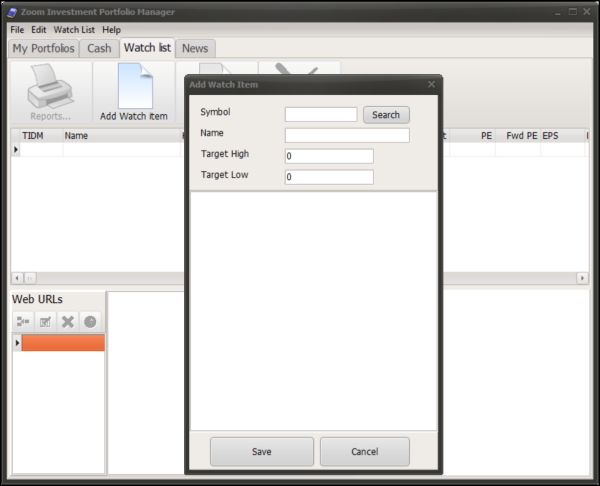

In addition to the above-discussed features, Zoom Investment Portfolio Manager lets you create a ‘Watchlist’ that helps to compare investments before making investment decisions or doing a bit of research in potential investments when markets are closed.

Under the Watchlist tab, you can specify different aspects related to a company, such as High target, Low target, PE, etc.

Lastly, there’s a cash accounting tab. It offers a complete overview of all the purchases and sales adjusted to the portfolio cash balance, keeping track of your uninvested cash. By default, it offers dual-mode

Simple mode – here, you just need to correct the balance when it is changed by cash adjustments (such as dividends or withdrawals).

Detailed Cash View – you can enter individual dividends and other receipts or payments.

You can switch between “Simple” and “Detailed” mode at any time.

The reports generated by Zoom Investment Portfolio Manager for various positions, including details about the transactions and dividends, can be exported to CSV file format.

If you need a free portfolio manager software, you may want to check it out. You can download it from sourceforge.net.

TakeStock 2 is another free Personal Investment Management software you may want to check out.

Leave a Reply